CBN Interventions Will Quicken Nigeria’s Exit From Recession – Ethnic Groups

Major ethnic youth groups have expressed high hopes that the robust economic policies of the Central Bank of Nigeria (CBN) would lead to a quick exit of Nigeria from the current recession.

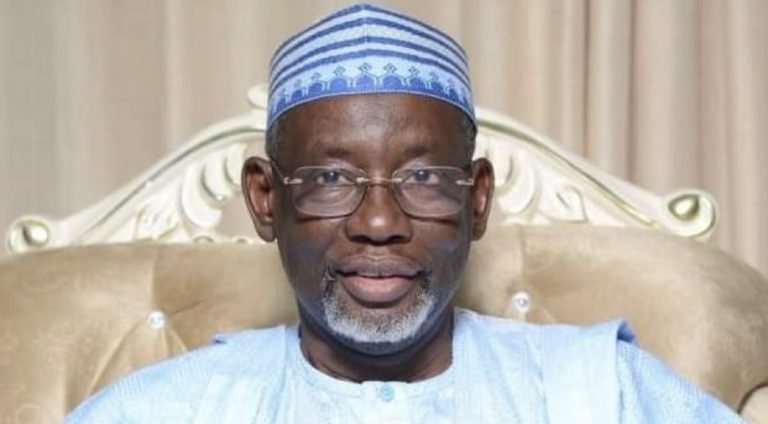

The groups in a communique issued at the end of a two session specifically passed a vote of confidence on the CBN Governor ,Godwin Emefiele , describing the various economic intervention programme of the bank as a major unifier for the country .

The groups include the Arewa consultative youth movement , the Ohaneze Ndigbo youth, the Oduduwa youth forum , South South youth council, and the Middle belt youth movement .

The youth groups in a five page communique read by the leader of the Middle Belt youth movement, Godwin Maliga urged Nigerians not to be discouraged by the reported fresh wave of economic recession in the land .

According to the group,these various economic policies of CBN,including its agric intervention programme are not only robust , but are youth friendly.

He said “the last time ,we exited in good time ,we are again hopeful that Nigeria will exit those second wave of recess quickly the Emefiele economic formula kick in.

“For the past two days, we have bent our backs while brainstorming on the review of the CBN economic intervention and its impact on young people in Nigeria.

“Nigerians will recall that the National Bureau of Statistics monthly releases figures and data which measure our economy. These figures have not been very favourable in recent times. Also the global poverty index figures have not been as beautiful as young people in Nigeria would have wanted it.

“These indices coupled with the combined negative impact of the COVID-19 lockdown and the #EndSARS protests which threatened the very fabrics of our national security were the motivation for convening this 2 day roundtable to analyze the role, functions, activities and interventions of the Central Bank of Nigeria and juxtapose them with the impact on young people in Nigeria.

“From available facts, the Central Bank of Nigeria is currently involved in several economic and unity interventions worth several hundreds of billions of Naira all across the country. These interventions include; The Youth Entrepreneurship Development Programme (YEDP), N75 billion Naira Nigeria Youth investment Funds, CBN funding of NIRSAL MFB with N12.5bn seed capital, N50 billion CBN Covid-19 intervention fund for SMEs.

Others are “Micro Small and Medium Enterprises Development Fund (MSMEDF), Agricultural Credit Guarantee Scheme Fund (ACGSF), Agricultural Credit Support Scheme (ACSS), Commercial Agriculture Credit Scheme (CACS), Accelerated Agricultural Development Scheme (AADS), Small & Medium Enterprises Equity Investment Scheme (SMEEIS), BOI/CBN Intervention Fund, CBN COVID-19 Targeted Credit Facility (TCF), CBN AGMEIS.

“CBN Real Sector Support Financing (RSSF), CBN Non-Oil Export Simulation Scheme (NESF), CBN Anchor Borrower’s Programme (ABP), CBN Creative Industry Financing Initiative (CIFI), CBN Maize Aggregation Scheme (MAS), CBN Health Care Intervention Scheme to mention but a few.

“A thorough analysis also showed that these schemes and intervention funds are available to thousands of young people who do not need recommendation or any letters from any person in high offices to get access.

“These interventions can also be described as the most robust, expansive and impactful interventions in the history of Nigeria central bank and worthy of commendation.

“Further study shows that with these interventions, many young people have been pulled out of idleness, have become gainfully engaged and this has in turn reduced crime and criminality, created jobs and expanded businesses.

“This is the crux of the Governor of the Central Bank of Nigeria, Mr. Godwin Emefiele economic formula. It is a formula that has proved to be both sustainable and workable hence very commendable.

He further said the Anchor Borrowers Programme has enabled small holder farmers who are in particular young persons to get value for their produce as they have a ready market to buy all their produce for processing.

According to him, also the repayment of the grants and loans is directly from the produce which is usually higher than those of the ordinary farmers as the compulsory training for all participating farmers enables them to produce more.

He further stated that the Creative Industry Financing Initiative provides finance in four principal areas including Fashion, Information Technology, Movie (production and distribution) and Music.

He said “ Loans ranging from N3 million to N500 million and it is accessible from any commercial bank at single digit interest rate with repayment time of up to 10 years. In support of entrepreneurship, the Micro, Small and Medium Enterprises Development Fund was established by the Bank with 60% dedicated for women.

“Following the intensive discussions and extensive consultations by the Ethnic Youth Leaders in Nigeria, in recognition of the outstanding performance of the Governor of the Central Bank of Nigeria and in appreciation of the amazing impact of the economic intervention programmes of the apex bank that we the Nigerian Ethnic Youth Leaders unanimously pass a vote of resounding confidence on the Governor of the Central Bank Mr. Godwin Emefiele.

He said the performance of the bank has earned it a seat at the high table of the most outstanding public institution in Nigeria particularly in this post COVID-19 economy.

“The Bank had been visionary especially in the area of strengthening our commercial banks to withstand global economic shocks, proactive in initiating and coordinating the Coalition Against COVID 19 (CACOVID), which helped vulnerable Nigerians to get access to palliatives and other basic materials and health workers to get access to Personal Protective Equipment (PPE) and essential drugs during the worst days of the COVID-19 lockdown.

“This Coalition mobilized over N27 Billion and all participating organizations are happy with the transparent and accountable handling of the money by the Central Bank.

“Gentlemen, while we were all gathered for this roundtable, our attention was drawn to the news that the country has yet again slipped into another recession.

“The last time, we exited in good time. We are again hopeful that Nigeria will exit this second wave of recession quickly as the Emefiele economic formula kicks in. This COVID-19 induced recession, which is not just a Nigerian but a global phenomenon, will pass over us and our country shall return to the path of prosperity.

“Fellow compatriots, what we all owe the bank is to support and encourage it now that it is doing very well and also as we go inform people from our various communities even when leave here that there are billions of Naira still waiting to be accessed by citizens particularly women and young people that can turn around their fortunes, lift them above the poverty line, reduce crime and criminality in the society and promote peace, law and order,” he stated .

Post Comment