U.S. to increase Africa’s annual development finance to $6b

The United States of America (USA) plans to increase its annual development finance to Africa by 20 per cent from about $5 billion to some $6 billion.

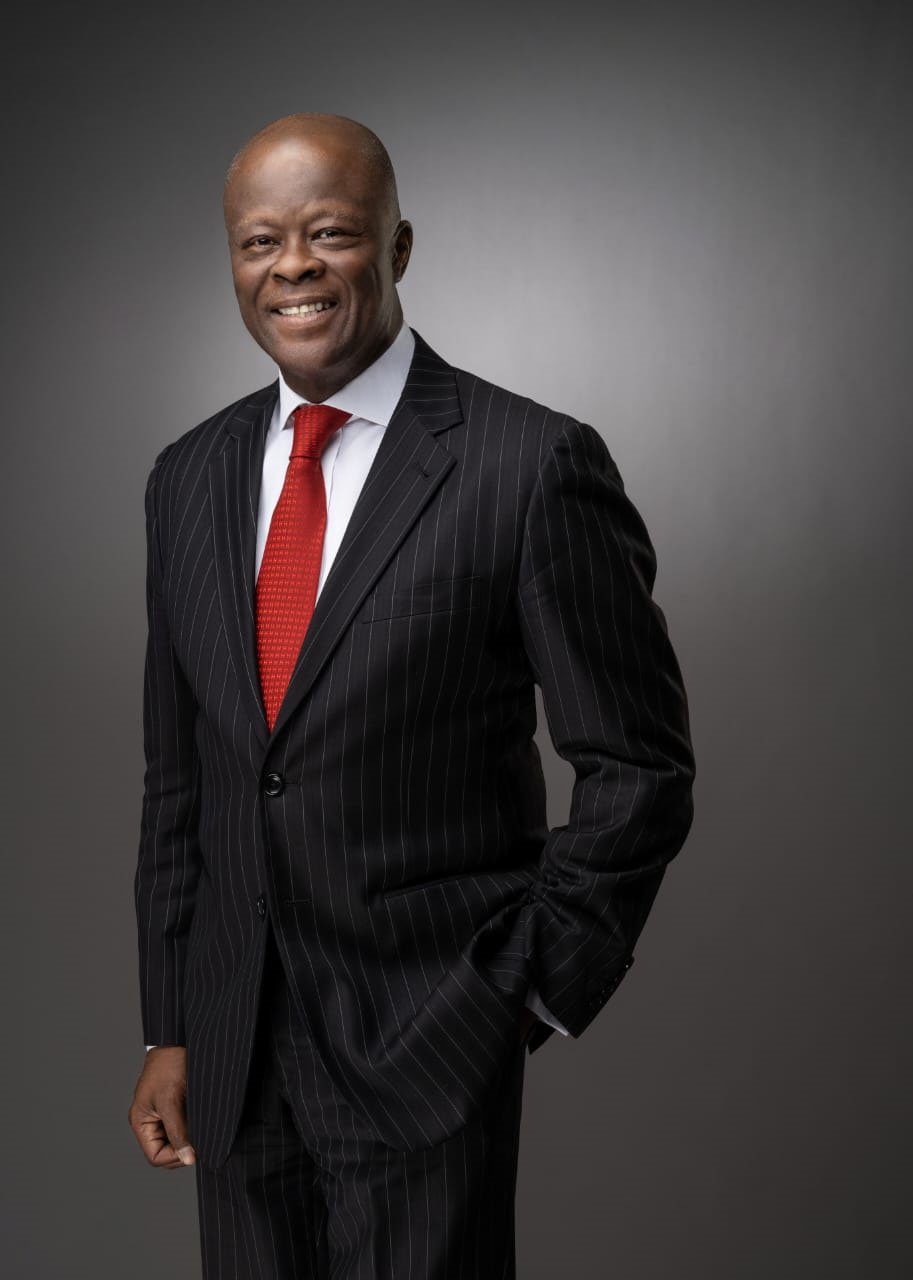

Chief Operating Officer, U.S. International Development Finance Corporation (DFC), David Marchick, who spoke at the weekend during the 17th annual conference of African Private Equity and Venture Capital Association (AVCA), commented on direct equity investments made by DFC across the continent and shared expectations for US-African collaboration.

According to him, the DFC is interested in significantly increasing its $4 billion to $5 billion annual average of commitments to Africa by 20 per cent.

At the conference, African governments, global and African decision-makers, institutional investors, fund managers and entrepreneurs resolved on the need for increased partnership between the public and private sectors in order to enhance the flow of investments into Africa.

The annual conference, which was held as a live virtual programme, more than 350 major private equity and venture capital practitioners from more than 50 countries discussed the trends and developments shaping Africa’s investment landscape in 2021 and beyond.

President Nana Akufo-Addo of Republic of Ghana, commended the private sector’s role in pushing Africa’s economy forward and building an inclusive and sustainable future.

He called for closer collaboration and cooperation between the public and private sector to achieve Africa’s resilience and resurgence, a message that ran through the conference themed “Resilience, Resurgence and Results”.

The conference explored Africa’s revival post-COVID, recovery timelines and the regional variation of its impact. Panellists, including Hurley Doddy, Co-Chief Executive Officer, Founding Partner, and Managing Director, Emerging Capital Partners, debated the role private investors should play in accelerating the continent’s recovery.

Senior Partner, AfricInvest, Khaled Ben Jilani shared how private equity could safeguard the livelihoods of MSMEs in Africa.

He underlined the areas best impacted by the pandemic, citing that new players in cross-border payments, digital lending, medical logistics, last-mile delivery and cross-border logistics will continue to be challengers to existing companies in years to come.

Partner, Alterra Capital Partners, Genevieve Sangudi emphasised the importance of active portfolio management with partners, and the value creation opportunities in the market.

She detailed how the pandemic had created new and increasingly critical products and services that have helped us overcome revenue downturns by generating new business opportunities, direct-to-consumer strategies and shaping geographic expansions.

A session dwelt on a range of evolving themes and emerging opportunities in African private equity (PE) landscape, such as gender-lens investing and the growing trend of high exit and acquisition for African fintech start-ups. Fund managers examined the emerging economies in Africa with rising opportunities and the well-established African PE markets such as Kenya, South Africa, Nigeria, Ghana, Egypt, and Morocco.

In a panel session, major speakers including Minister of Industry, Trade and Investment, Otunba Adeniyi Adebayo, addressed the recent regulatory and policy changes affecting private investment on the continent with Emma Wade-Smith OBE, Her Majesty’s Trade Commissioner (HMTC) for Africa at the UK’s Department for International Trade and Tania Rödiger-Vorwerk, Director Private Sector, Trade, Employment and Digital Technologies, German Federal Ministry for Economic Cooperation and Development.

Chief Executive Officer, African Private Equity and Venture Capital Association (AVCA), Abi Mustapha-Maduakor, noted that it was a delight to have convened major industry players and key decision-makers virtually at the annual conference.

independent industry research, best practice training programmes and exceptional networking opportunities.

With a global and growing member base, AVCA members span private equity and venture capital firms, institutional investors, foundations and endowments, pension funds, international development finance institutions, professional service firms, academia, and other associations.

Post Comment